As HNN has commented in the past, tracking renovations (alterations and additions) is always a little tricky. For example, the Australian Bureau of Statistics (ABS) limits all Building Approval data to projects costing more than $10,000, which excludes a large number of actual renovations.

In general, there is always going to be some doubt about absolute numbers, but what we can track relatively accurately are trends. If there are errors in data collection, they tend to be consistent errors, so if the numbers go up or down, they likely reflect the same movements in the underlying markets.

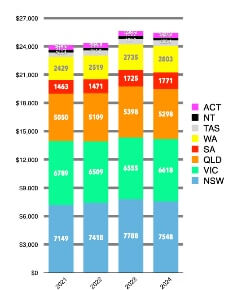

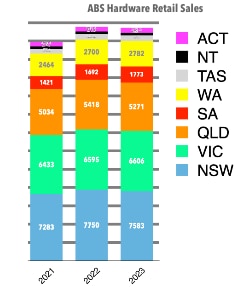

Unfortunately, this group of statistics is not really suited for managing the smaller regions in Australia, notably Tasmania, the Northern Territory and the Australian Capital Territory. To adequately manage those we need access to chain volume statistics, which will be out for the March quarter 2024 in the near future. When we have access to those, we'll do a deeper analysis of those regions.

So what we're attempting to achieve here is not to be definitive, but rather indicative. The statistics we've chosen to use are as follows:

Building Approvals for alterations and additions (alts & adds) including conversions

Loans for alts & adds

National Accounts final household demand for alts & adds

Combining all those stats, we should be able to see some trends in each state.

It's worth delving into these data somewhat comprehensively, because the alts & adds market has become very complex going into calendar 2024. We've seen a slight cooling in the housing market (though not in all areas and all sectors). This is combined with ongoing high interest rates (which, as HNN has suggested in the past, are unlikely to fall through 2024). These contribute to overall increases in the cost of living, driven both by inflation, and opportunistic price increases in Australia's semi-monopoly markets.

Thus there is retardation in the overall market, as Australia's economy staggers under both inflation and the cure for inflation. Yet there is also stimulus in the alts & adds market, as increased house prices and concerns about market stability reduce the willingness of home owners to sell, and increase the attractiveness of "fixing up" a current abode.

HNN also commented earlier that it seemed unlikely to us that the "standard" market analysis would work in 2024. This suggests that when the housing market falls, spending shifts to alts & adds. The scenario that gets omitted in that analysis is what happens when strong exterior influences affect the total market. In that case, you could see falls in both renovations and housing, or increases in both. It's not clear that this is entirely the case for 2024, but it is certainly a year for external influences to play a part in all markets, it would seem.

The monthly data is presented in 12-month periods, which run from March to February. So p2022 refers to a period running from March 2021 through to February 2022, for example. Quarterly data is presented in calendar years for this data series.

New South Wales

Building Approvals

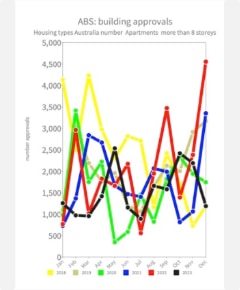

It's interesting to contrast the two sets of stats we have for building approvals: the number of approvals and the total costs of approvals.

The chart clearly shows that p2024 trails p2023.

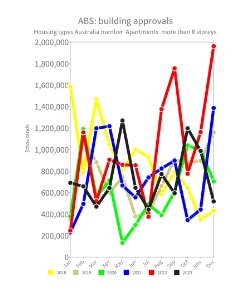

The value chart shows a different picture, grouping together p2022, p2023 and p2024 apart from the previous four years. That is further born out when we consolidate the monthly data into 12-month periods.

This indicates that while the value spent on alts & adds has remained relatively steady, the number declined sharply for p2024.

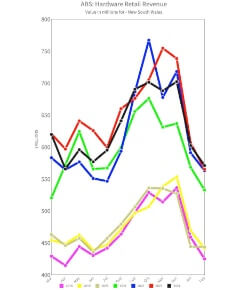

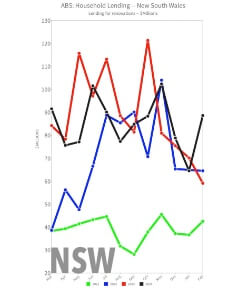

Lending

The lending stats from the ABS follow a different pattern.

We can start to unravel this by looking at the numbers for p2023 (the red line), which begins with very high numbers from March 2022 through to August 2022, then drops from September 2022 through to February 2023 to a level that either matches p2022 or is below it. Following that, p2024 underperforms on p2023, but broadly matches p2022.

Both p2022 and p2023 show a high degree of volatility, especially for p2023. It is difficult, on a monthly basis, to really discern any patterns - there is very little seasonality, for example. The only real pattern is the four-month decline from November 2022 through to February 2023 (shown in the red line for p2023).

Some patterns can be seen in the 12-month consolidation for these data. The transitions from p2021 through to p2023 follow an expected pattern - an increase in the number of loans corresponding to an increase in the total value of those loans. That pattern is altered for p2024, where the number of loans decreases significantly, but the value decreases less proportionate to that.

National Accounts

As quarterly results, the survey for household spending on alts & adds does not reflect any data for 2024, but gives a "grounded" indication of what is going on in the market. It clarifies, for instance, just how extreme the growth has been in alts & adds since the beginning of the COVID-19 pandemic.

This also presents a simple illustration of what many have intuitively supposed was happening in the alts & adds market: increased demand in the first quarter of 2023 as compared to 2022, parallel demand to 2022 in the middle quarters, and decreased demand in the final quarter.

Analysis

Numbers of building approvals decreasing while overall spending remains static indicates that a split has developed in the NSW renovation market. We can combine that with the lending numbers, which show a decline, but a much less significant one. For example, a similar number of loans for p2022 show a much lower value than for p2024. This would indicate that the decline in largely in self-financed renovations. The two possible scenarios is that those renovations were of relatively low value, as did not affect the overall number as much, or that as some renovators dropped out of the market, those that did remain have increased their spending.

Victoria

Building Approvals

One aspect of building approvals for Victoria that must be mentioned is the overall decline in alts & adds as reported by the ABS. The chart below illustrates the number of alts & adds reported by the ABS for financial years.

As this shows, in terms of what the ABS considers alts & adds, there has been an ongoing decline since 2018.

Moving on to the monthly numbers as reported by the ABS, what is most notable in comparison with the NSW data is the lack of volatility.

What volatility there is, such as the spike for February 2023 (the red line) is caused by the addition of data for conversions along with pure alts & adds (which is necessary as the value data for approvals is only provided with the two combined). The most recent volatility is for p2021 (the green line), which, running from March 2020 to February 2021, would have been at the start of the pandemic period. While p2022 shows some increased activity, both p2023 and p2024 are more subdued.

The values for alts & adds shows something quite different.

What is interesting here is just how similar the most recent three periods are. There is some additional volatility to p 2022, but there is a strong seasonal pattern running from November through to February in all three periods.

What is happening is more clearly outlined in the chart that totals these 12-month periods.

This shows an immediate shift, starting with p2022, where the value reaches a local high, and maintains that through three periods. This seems to exist almost independent of the actual numbers, which is especially noticeable for p2024, with numbers reaching a new local low.

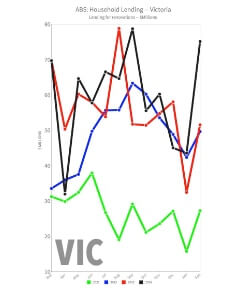

Lending

It is evident that the number of loans has fallen substantially for p2024.

The most substantial declines are for April 2023 and December 2023.

The story for the value of loans, however, is quite different.

As we saw with NSW, even as numbers fall, values increase. The exception to this would be for April 2023, where a strong fall coincides with the fall in number of loans. But that is contradicted by the February 2024 loan values, which climb steeply, while loan numbers increase more modestly.

Looking at the 12-month totals for the lending stats, we can see a trend somewhat similar to that for NSW.

Again for p2024 there is a reduction in the number of loans, but an increase in the total value for those loans.

National Accounts

As with NSW, the alts & adds reflected in National Accounts show a somewhat more stable pattern.

This shows alts & adds for 2023 tracking slightly above those for 2022 at the start of the year, following below, then tracking considerably higher for the September quarter. The end of 2023 shows a near match on 2022.

Analysis

Similar to NSW, we're likely seeing a split in the market. Fewer loans for a larger amount, a trend that is echoed for building approvals.

Queensland

Building Approvals

The numbers of approvals for alts & adds, leaving aside the spike for December 2022 from conversions, have remained remarkably stable.

The only real spike has been for June 2023.

Surprisingly, the values have also remained stable.

The dominant driver remains seasonality.

The 12-month overview shows some differences to those for NSW and VIC.

While the part of this pattern that is familiar is the value of approvals remaining nearly constant for p2022 through to p2024, what is different is that the number of approvals goes both up and down.

Lending

In contrast to approvals, lending remains quite volatile.

Overall, however, there is an evident reduction in numbers for p2024 as contrasted with p2023.

Not surprisingly, there has been more stability in the value of loans.

The most interesting feature of this chart is the increase between February 2022 and March 2023, which is something like a pandemic "before and after", with values subsequent to March 2023 entering a new region of consistent highs.

The 12-month summary for lending also seems familiar.

The pattern of a reduced number of loans but a constant overall value is repeated.

National Accounts

The estimation of household spending on alts & adds from the National Accounts does show a difference from NSW and VIC.

Spending for 2023 does rise above that for 2022 in the June quarter, but there is a sharp drop for the December quarter.

Analysis

While there are some broad similarities with NSW and VIC, QLD Is also unique. The pattern for spending reflecting in approvals is for a high spend per approval in p2022, followed by a reduced spend in p2023, and a return to a moderately high spend in p2024. The lending data reflects that, though in a diminished way.

South Australia

Building Approvals

After the east coast states, stats for SA seem quite unique.

There is a degree of volatility for p2022, followed by a less volatile p2023, then a somewhat volatile p2024.

In terms of value of approvals, these show a more constrained range of movement, with a strong peak in November 2023.

While some of this chart looks familiar, it is telling a very different story to the east coast states. There is a steady increase in 12-month total values of approvals from p2020 onwards, while the numbers fluctuate. For p2023 there is a reduction in number of approvals, while value continues to grow. However this is followed by a strong increase in numbers for p2024 without a commensurate increase in value.

Lending

The lending numbers are volatile for p2022 and p2024, but more stable for p2023.

There is a similar volatility for the value of loans.

The strongest pattern is an increase for p2024 from the low in September 2023 through to the high in January 2024 - though this is followed by a steep fall in February 2024.

The 12-month view on lending reflects the results from approvals.

In something of a reversal from the east coast states, we see in p2023 an increase in the number of loans, with only a small lift in their total value. This reverses in p2024, with the number of loans decreasing while the value rises.

National Accounts

The pattern here is to see 2023 outperforming 2022, which is itself far above 2021.

Analysis

It would seem that p2023 would have been something of a consolidating period in market, with activity centred on slightly lower-value expenditure on more alt & adds activity.

Western Australia

Building Approvals

Unfortunately, with the low level of approvals reported by the ABS, the chart of stats becomes less clear. What can be discerned is that the level of activity for p2024 is above that for both p2022 and p2023.

In terms of values, we can see that p2024 is clearly boosted above the two preceding years. While seasonality continues to play something of a role, October and November 2023 have been boosted considerably, as has February 2024.

WA shows something of an individual pattern. In p2022 there is a sharp shift in the value of approvals, with numbers reducing while value increases. However, something of that new ratio hold true for the two subsequent periods, with the numbers corresponding more or less with the value.

Lending

Perhaps the most interesting feature of this chart is that while there is some seasonality in p2021, p2023 and p2024, p2022 seems to break away from this, starting in April 2021.

The value of loans seems to follow a similar pattern, with p2023 something of a break-away. So p2024 follows much of p2022, with the exception of a kick upwards for December 2023, January 2024 and February 2024 at the end.

The 12-month values show a real "normality" in lending. The value of loans steadily increases from p2022 onwards, and so does the number of loans issued.

National Accounts

The results for household spending on alts & adds in the National Accounts show a more optimistic picture. 2023 shows considerable gains over both 2021 and 2022.

Analysis

WA escaped much of the early consequences of the COVID-19 pandemic (due largely to sane and smart management, as well as some isolation). But was influenced post COVID-19 by economic changes. It seems likely the state is also going to escape some of the more dire forces at work in the other states, especially as regards poor planning for housing demand.

Overall analysis

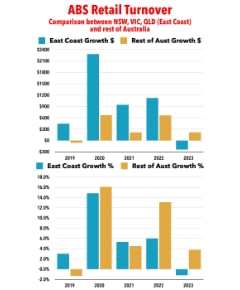

It should be clear from considering these stats that we're really not looking at a "regular" period for alts & adds. Universally, there has been an increase on expenditure in this area since the pandemic, and nothing in these numbers suggests that is going to end abruptly.

What we are seeing, however, are different growth patterns. One possibility is that the market is beginning to split in the east coast states somewhat into "have" and "have not" strata. That is, we could see already expensive housing migrating through renovation and extension to be even more expensive, while the stratum below that seeks to remain in the realm of "achievable" purchase.